People participate in a "March on Billionaires" event on July 17, 2020 in New York City. The march, which included a diverse group of activists, politicians and citizens, called on New York Governor Andrew Cuomo to pass a tax on billionaires and to fund workers excluded from unemployment and federal aid programs. Joining the marchers were dozens of taxis whose drivers have been especially impacted by the drop ridership due to Covid-19. According to data from the Organization for Economic Cooperation and Development, income inequality in the United States is the highest of all G7 nations. (Photo by Spencer Platt/Getty Images)

A tax loophole allowed the richest Americans to shield their investments and sit on $8.5 trillion in untaxed profits in 2022, according to a report released last week by American for Tax Fairness.

The report, which was based on an analysis of Federal Reserve data, found that although these Americans—who are each worth more than $100 million—made up just .05% of all American households in 2022, they held one-sixth of the “unrealized capital gains” in the United States that year.

While most American families must work and earn paychecks to support themselves, these unrealized gains function as the primary source of income for many ultra-wealthy families, according to the report.

Current law states that growth in the value of assets–such as stocks, bonds, and real estate and business investments–isn’t taxable until they are “realized,” or sold. Therefore, centimillionaires and billionaires are able to live off these “unrealized” gains by taking out low-interest loans against their wealth. Ultimately, these fortunes turn into inheritances, and that money never gets taxed—unless Congress closes that loophole.

Democratic lawmakers have sought to remedy the problem, introducing a “Billionaires Income Tax” in both the House, and the Senate. The tax would apply to those unrealized capital gains, and according to data, could generate an estimated $500 billion in new revenue in the United States over the next 10 years.

President Joe Biden also supports fixing the loophole in order to tax unrealized gains, but these efforts have received zero support from Republicans.

During Biden’s 2023 State of the Union speech, he called out billionaires who pay lower taxes than the middle class.

“Let’s finish the job. Reward work, not just wealth. Pass my proposal for a billionaire minimum tax,” he said. “Because no billionaire should pay a lower tax rate than a school teacher or a firefighter.”

Without congressional action, it’s predicted that the wealth of the ultra-rich will continue to grow. Since the Federal Reserve began collecting data on American household income and wealth 35 years ago, households worth more than $100 million have nearly tripled their share of the country’s unrealized gains, according to the report.

This disparity in how the ultra-wealthy are taxed only serves to deepen racial divides in the country, as well, the report says. Of that $8.5 trillion in 2022, almost 90% of it was held by white households.

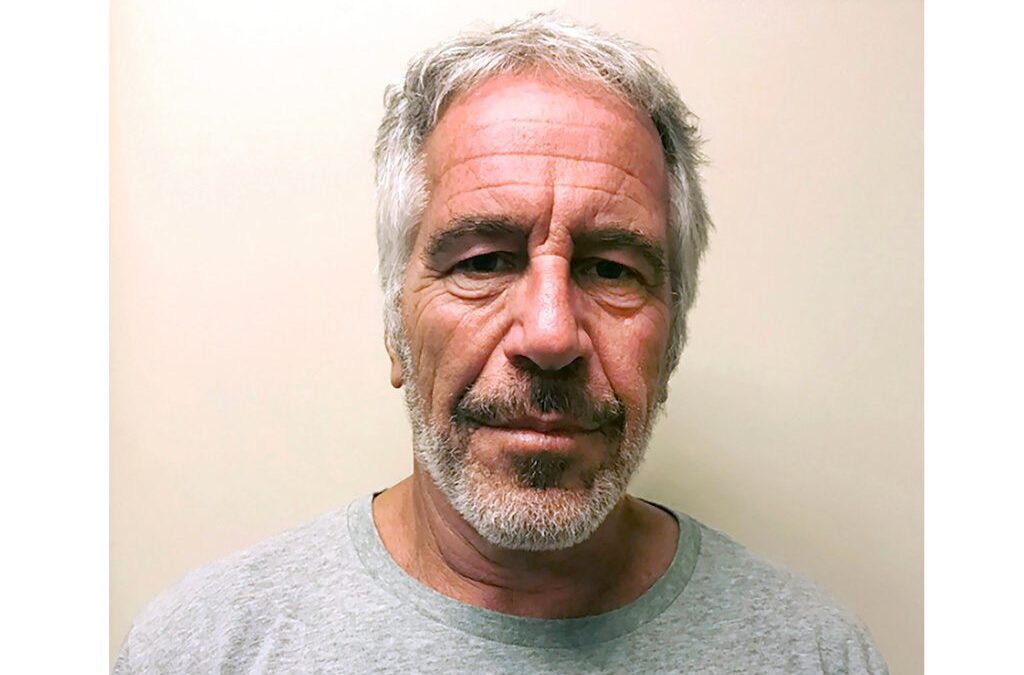

Epstein email says Trump ‘knew about the girls,’ but White House says release is a Democratic smear

WASHINGTON (AP) — The sex-offending financier Jeffrey Epstein wrote in a 2019 email to a journalist that Donald Trump “knew about the girls,"...

John E. Sununu launches NH campaign for US Senate seat, seeks Trump meeting

His entry comes as Republicans fear another federal election loss as Democrats hold strong polling advantage. Former US Sen. John E. Sununu (R-NH)...

Dems to infuse cash into New Hampshire elections

The Democratic National Committee (DNC) announced a cash investment to boost the party’s early organizing ahead of 2025 municipal contests and the...

How a federal shutdown would hit New Hampshire

Social Security and VA continue, but SBA loans, USDA housing, and national-forest services could stall. Pappas’s plan would protect military pay,...

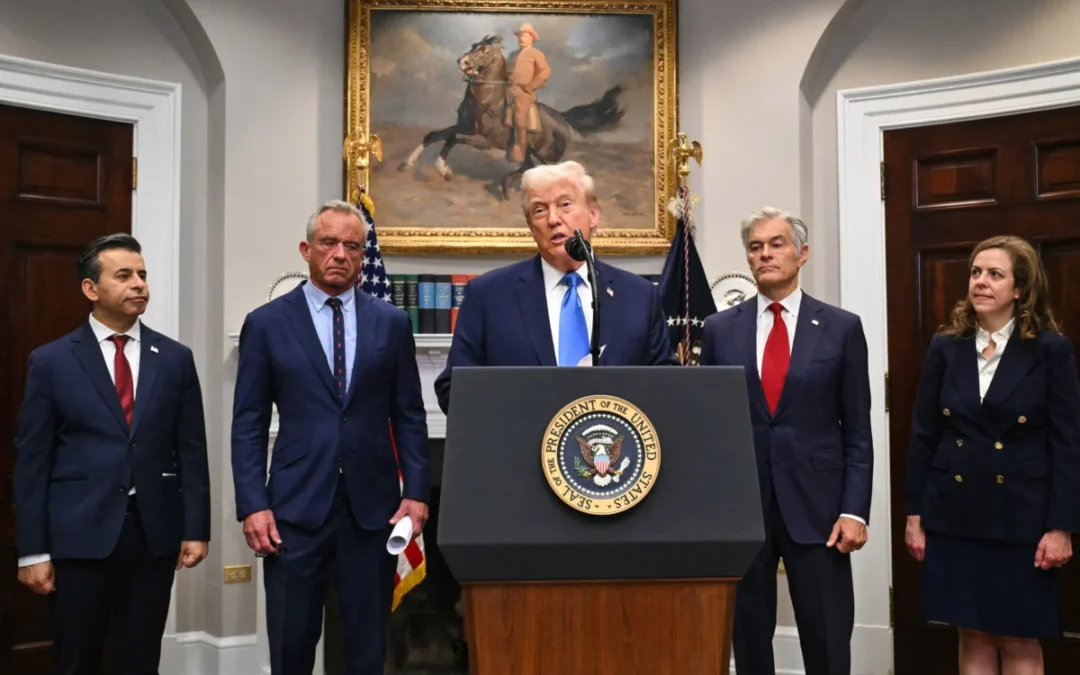

‘Sick to my stomach’: Trump distorts facts on autism, tylenol, and vaccines, scientists say

By Amy Maxmen Originally published September 22, 2025 Ann Bauer, a researcher who studies Tylenol and autism, felt queasy with anxiety in the weeks...

Conservative activist Charlie Kirk dies after being shot at Utah college event

OREM, Utah (AP) — Charlie Kirk, a conservative activist and close ally of President Donald Trump, was shot and killed Wednesday at a Utah college...